The Power of Automating Know Your Customer (KYC) Processes: Why Speed Matters

In today’s digital world, businesses across industries—especially in finance, fintech, and e-commerce—are under increasing pressure to onboard customers quickly while adhering to strict regulatory requirements. The Know Your Customer (KYC) process, a critical step in verifying customer identities and mitigating risks like fraud and money laundering, has traditionally been a bottleneck. Manual KYC checks are time-consuming, error-prone, and expensive. Enter automation—a game-changer that streamlines KYC, boosts efficiency, and enhances customer experience. In this blog post, we’ll explore why automating the KYC process is essential and why speed is a competitive advantage.

What is KYC and Why Does It Matter?

KYC is a regulatory framework requiring businesses to verify the identity of their customers, assess their risk profiles, and ensure they aren’t involved in illegal activities like money laundering, terrorism financing, or identity theft. For banks, cryptocurrency exchanges, and other regulated entities, KYC isn’t optional—it’s a legal mandate enforced by bodies like the Financial Action Task Force (FATF) and local regulators.

The stakes are high. Non-compliance can lead to hefty fines, reputational damage, and operational setbacks. At the same time, customers expect seamless onboarding experiences. A slow or clunky KYC process can drive them to competitors who get it right. Balancing compliance with customer satisfaction is tricky—but automation offers a solution.

The Case for Automating KYC

Manual KYC processes rely on human reviewers sifting through documents, cross-checking databases, and flagging inconsistencies. This approach doesn’t scale in a world where businesses onboard thousands (or millions) of customers daily. Automation leverages technology—AI, machine learning, and data analytics—to handle these tasks faster and more accurately. Here’s why it’s a no-brainer:

- Speed and Efficiency

Automated KYC systems can verify identities in seconds by scanning IDs, running facial recognition, and cross-referencing data against global watchlists. What once took days or weeks can now happen in real time, allowing businesses to onboard customers instantly. - Cost Reduction

Hiring staff to manually process KYC checks is expensive. Automation cuts labor costs, reduces human error, and frees up resources for higher-value tasks like customer support or product development. - Accuracy and Compliance

AI-powered tools can detect forged documents, spot anomalies, and ensure compliance with evolving regulations. They’re less prone to oversight than tired human eyes and can adapt to new rules quickly. - Scalability

Whether you’re a startup onboarding your first 100 users or a global firm handling millions, automated KYC scales effortlessly. It grows with your business without requiring proportional increases in staff or budget.

Why Speed is a Competitive Edge

A quick KYC process isn’t just about operational efficiency—it’s a customer experience differentiator. Here’s why speed matters:

- First Impressions Count

Studies show that 70% of customers abandon onboarding if it takes too long. In a world of instant gratification—think one-click purchases and same-day delivery—a sluggish KYC process feels like a relic. A fast, frictionless experience builds trust and keeps customers engaged. - Reducing Drop-Off Rates

Every minute a customer waits for approval is a minute they might reconsider their choice. A 2023 report by Signicat found that 63% of consumers abandon financial applications due to lengthy identity verification. Speed keeps them in the funnel. - Staying Ahead of Competitors

In crowded markets like fintech or crypto, where dozens of players vie for the same customers, a rapid KYC process can set you apart. If your competitor takes three days to verify a user while you do it in three minutes, guess who wins? - Enabling Real-Time Business

For industries like cryptocurrency trading or online gaming, where users expect immediate access, a slow KYC process kills the vibe. Automation ensures your platform operates at the speed of modern expectations.

How Automation Works in Practice

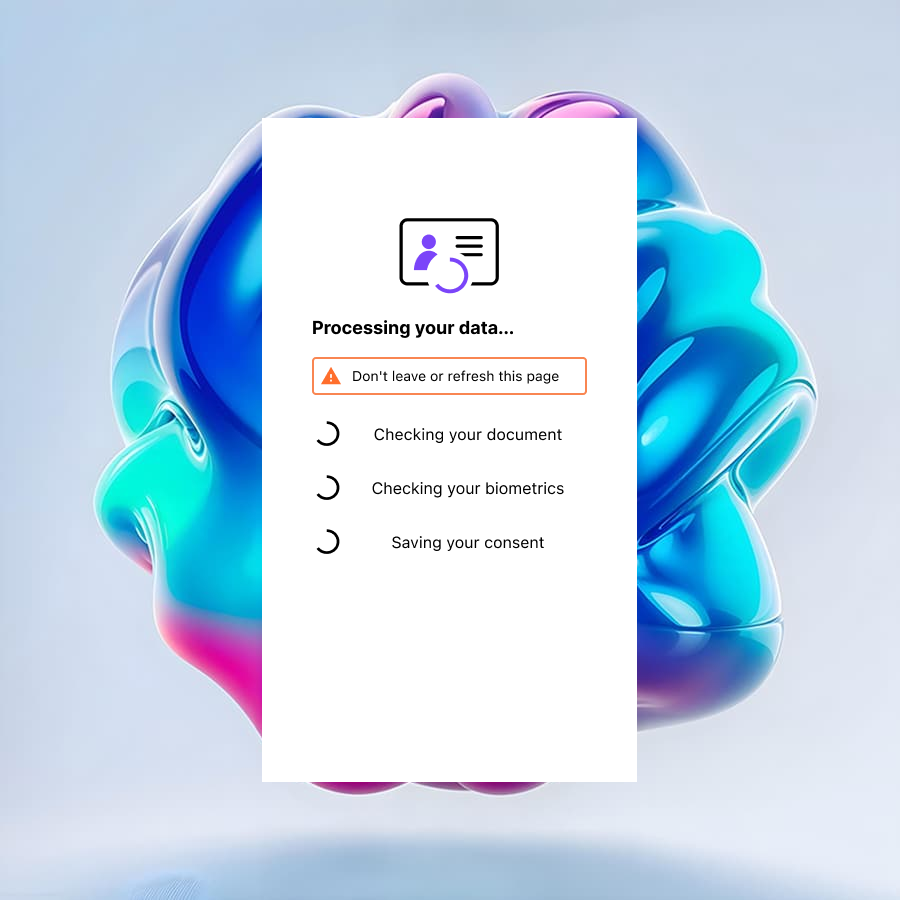

So, what does an automated KYC process look like? It’s a blend of cutting-edge tech and smart workflows:

- Document Verification: Customers upload IDs (passports, driver’s licenses) via a mobile app or website. AI scans and authenticates them in seconds, checking for tampering or fraud.

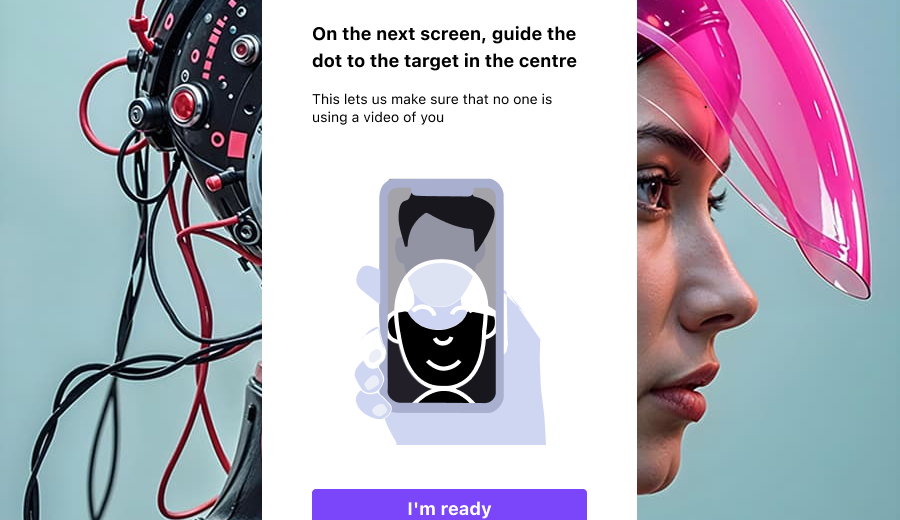

- Biometric Checks: Facial recognition matches a selfie to the ID photo, ensuring the person is who they claim to be.

- Database Screening: Algorithms cross-check customer data against sanctions lists, politically exposed persons (PEPs) databases, and adverse media in real time.

- Risk Scoring: Machine learning assigns a risk profile to each customer, flagging high-risk cases for human review while greenlighting low-risk ones instantly.

Take a company like Revolut, a fintech unicorn. By automating KYC, they’ve slashed onboarding times to under five minutes for most users, helping them grow to over 20 million customers. That’s the power of speed at scale.

Challenges and Considerations

Automation isn’t a silver bullet. Businesses must ensure their systems are secure, privacy-compliant (think GDPR or CCPA), and capable of handling edge cases—like poor-quality ID scans or unusual customer profiles. Over-reliance on tech can also alienate users who prefer human interaction. The key is balance: automate the grunt work, but keep humans in the loop for exceptions.

The Future of KYC

As technology evolves, so will KYC. Blockchain could enable decentralized identity systems, letting customers share verified credentials without repetitive checks. AI will get smarter at spotting deepfakes and sophisticated fraud. But one thing won’t change: speed will remain a priority. In a hyper-competitive, customer-centric world, businesses that can’t keep up will fall behind.

Final words

Automating the KYC process isn’t just about ticking regulatory boxes—it’s about delivering a fast, seamless experience that customers love while staying compliant and cost-efficient. Speed isn’t a luxury; it’s a necessity. By embracing automation, businesses can turn a traditional pain point into a strategic advantage, building trust and loyalty in an instant. In 2025 and beyond, the message is clear: when it comes to KYC, slow and steady loses the race.