World of Global KYC Regulatory Requirements

In today’s interconnected financial landscape, businesses—especially those in fintech, banking, and cryptocurrency—are under increasing pressure to comply with global Know Your Customer (KYC) regulations. These rules, designed to prevent money laundering, terrorist financing, and other illicit activities, vary widely across jurisdictions, making compliance a daunting challenge. Yet, meeting these requirements is not just a legal obligation—it’s a cornerstone of building trust with customers and regulators alike. So, how can businesses effectively navigate this complex terrain? Let’s break it down.

What is KYC, and Why Does It Matter?

KYC is a process through which businesses verify the identity of their customers, assess their risk profiles, and ensure they’re not engaging in suspicious activities. It’s a critical part of Anti-Money Laundering (AML) frameworks worldwide. From onboarding new clients to monitoring ongoing transactions, KYC helps organizations stay on the right side of the law while protecting their operations from fraud.

The stakes are high: non-compliance can lead to hefty fines, reputational damage, and even criminal penalties. In 2023 alone, global regulators issued billions in fines for AML and KYC violations, underscoring the importance of getting it right.

The Global Patchwork of KYC Regulations

One of the biggest hurdles in meeting KYC requirements is the lack of a universal standard. Each country—or even region within a country—has its own rules, shaped by local laws, economic priorities, and risk tolerances. Here’s a snapshot of the diversity:

- United States: The Bank Secrecy Act (BSA) and the USA PATRIOT Act mandate robust customer identification programs (CIP) for financial institutions. The Financial Crimes Enforcement Network (FinCEN) also requires businesses to report suspicious activities and maintain detailed records.

- European Union: The EU’s 5th and 6th Anti-Money Laundering Directives (AMLD5 and AMLD6) emphasize enhanced due diligence, especially for high-risk customers and politically exposed persons (PEPs). GDPR adds another layer, requiring data privacy compliance alongside KYC efforts.

- Asia-Pacific: Singapore’s Monetary Authority of Singapore (MAS) enforces strict KYC guidelines, while countries like India have introduced Aadhaar-based e-KYC systems to streamline verification for their massive populations.

- Emerging Markets: In regions like Africa, where mobile money is king, regulators are balancing financial inclusion with KYC compliance, often allowing tiered approaches based on transaction limits.

This patchwork creates a juggling act for businesses operating across borders. A KYC process that satisfies one regulator might fall short in another jurisdiction.

Strategies for Meeting Global KYC Requirements

So, how can organizations stay compliant without drowning in complexity? Here are some practical strategies:

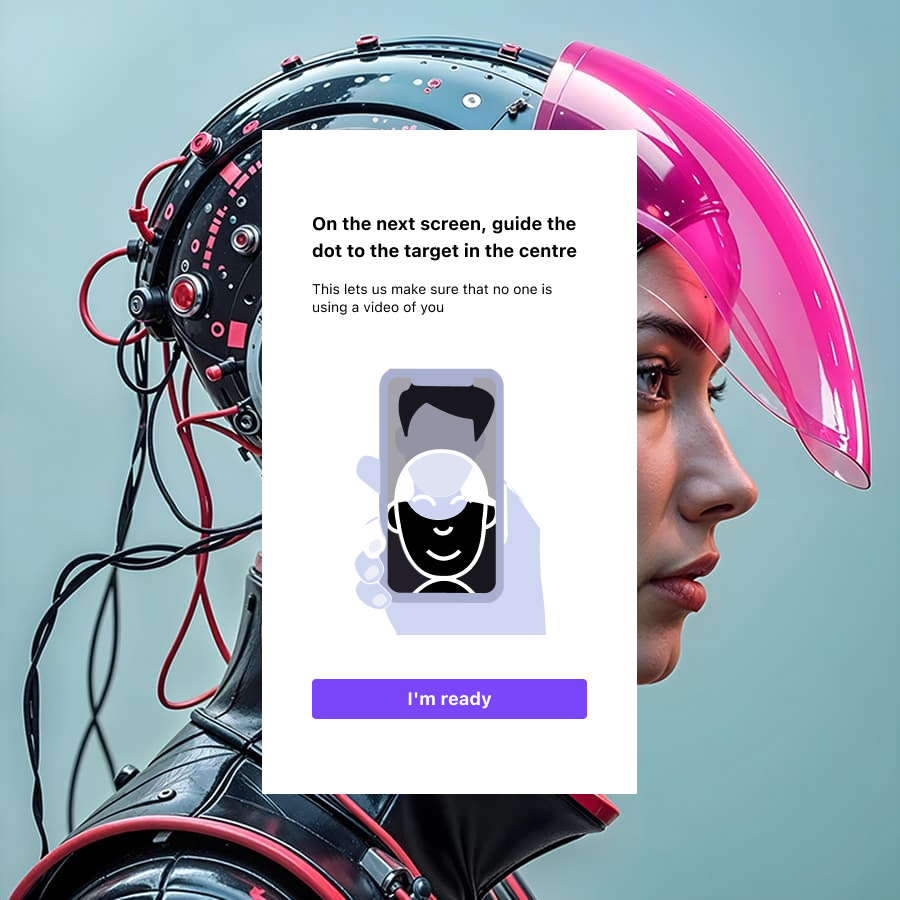

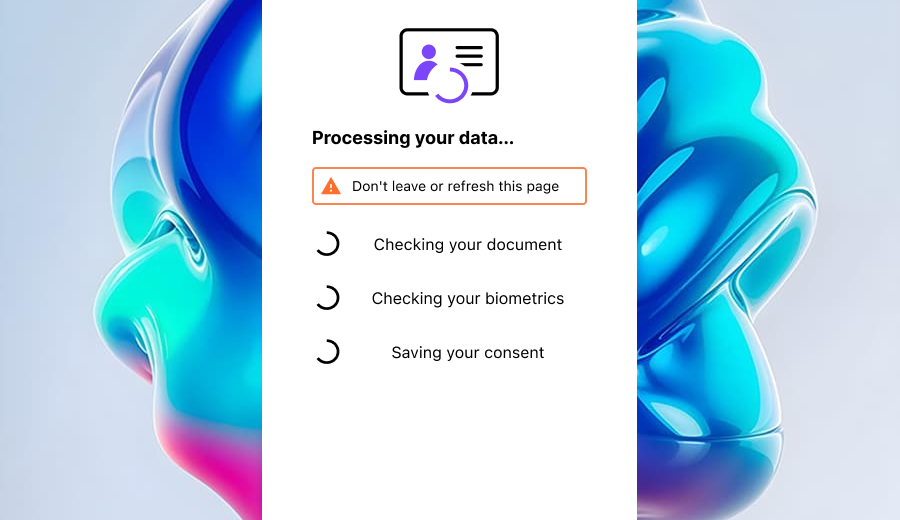

- Leverage Technology: Manual KYC processes are no match for today’s scale and speed. Automated solutions—powered by AI, machine learning, and blockchain—can streamline identity verification, screen for sanctions lists, and flag suspicious behavior in real time. Digital identity systems, like those tied to biometrics or government-issued IDs, are also gaining traction.

- Adopt a Risk-Based Approach: Not all customers pose the same risk. A risk-based approach—required by many regulators—lets businesses tailor their KYC efforts. Low-risk clients might need basic ID checks, while high-risk ones (e.g., PEPs or those in sanctioned regions) require enhanced due diligence.

- Centralize and Standardize: For multinational companies, a centralized KYC framework can reduce redundancy. Standardizing core processes—while allowing flexibility for local rules—ensures consistency without reinventing the wheel in every market.

- Stay Updated: Regulatory landscapes evolve fast. The Financial Action Task Force (FATF), which sets global AML standards, regularly updates its recommendations. Subscribing to regulatory alerts and consulting with local experts can keep you ahead of changes.

- Train Your Team: Technology alone isn’t enough—your staff needs to understand the “why” and “how” of KYC. Regular training on red flags, data handling, and jurisdiction-specific rules can prevent costly mistakes.

The Role of Collaboration

No business is an island in the fight against financial crime. Sharing KYC data (where legally permissible) through consortiums or utilities—like the KYC Registry in banking—can cut costs and boost efficiency. Regulators are also warming to public-private partnerships, recognizing that collaboration can strengthen the system.

Looking Ahead: The Future of KYC Compliance

As digital transactions soar and criminals get savvier, KYC requirements will only grow stricter. Emerging trends—like decentralized finance (DeFi) and central bank digital currencies (CBDCs)—are already forcing regulators to rethink traditional approaches. Meanwhile, customers expect seamless onboarding, putting pressure on businesses to balance compliance with user experience.

The good news? Innovation is keeping pace. From AI-driven risk scoring to privacy-preserving technologies like zero-knowledge proofs, the tools to meet global KYC demands are evolving. Businesses that invest in adaptability now will be best positioned for whatever comes next.

Final words

Meeting global KYC regulatory requirements is no small feat, but it’s a non-negotiable part of doing business in a globalized world. By embracing technology, tailoring processes to risk, and staying proactive, organizations can turn compliance from a burden into a competitive edge. After all, in an era where trust is currency, robust KYC isn’t just about following the rules—it’s about building a foundation for long-term success.